Key Takeaways:

- Business setup in Dubai costs are highly variable, influenced by jurisdiction (mainland vs. free zone), business activity, and chosen office space.

- Licensing fees are a primary expense and vary significantly based on the type of license and number of activities.

- Office space, whether physical or virtual, is a mandatory cost component.

- Visa costs for owners and employees are a significant consideration, especially for multiple staff.

- Ongoing expenses like renewals, accounting, and compliance should be factored into your long-term budget.

Dubai is renowned as a global business hub, attracting entrepreneurs and companies with its strategic location, tax benefits, and progressive economic environment. While the opportunities are vast, a common question for anyone looking to establish a presence is: “What are Business setup in Dubai costs?” The answer is not straightforward, as expenses can vary widely depending on several factors. This article will break down the typical costs involved, helping you budget effectively for your venture.

Factors Influencing Business setup in Dubai Costs

The overall expense of Business setup in Dubai is influenced by several critical decisions you make at the outset. Understanding these factors is key to getting an accurate estimate.

Firstly, your choice of jurisdiction plays a major role. Dubai offers two primary options: mainland and free zones. Mainland companies, registered with the Department of Economy and Tourism (DET), generally have higher initial setup costs due to requirements like a physical office space and, in some cases, the need for a local service agent (though 100% foreign ownership is now possible for many activities). Free zones, conversely, often provide more cost-effective solutions, particularly for startups and small businesses, with offerings like flexi-desks and a broader scope for 100% foreign ownership.

Secondly, the nature of your business activity directly impacts the cost of your trade license. Different activities, from general trading to professional services or industrial production, require specific licenses, each with its own fee structure. Businesses engaged in highly regulated sectors may also incur additional approvals and permits, adding to the overall expense. The number of activities you wish to include on your license can also increase the cost.

Initial Fees for Business setup in Dubai

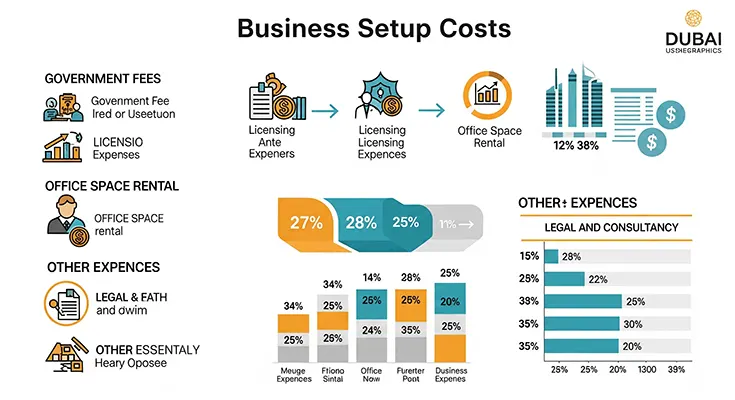

When you initiate your Business setup in Dubai, several upfront fees are mandatory. These generally include:

The trade name reservation fee, which secures your chosen company name, is a relatively minor but essential cost. This fee ensures your business name is unique and compliant with local regulations. Following this, you will pay initial approval fees to the Department of Economy and Tourism (DET) for mainland companies or the relevant free zone authority. This preliminary approval signifies that your business concept is accepted.

The most significant initial expense is the trade license fee. This annual fee varies considerably based on your business activity. For example, a commercial license for trading activities might have a different cost than a professional license for consulting services. Free zone licenses typically start from around AED 10,000 to AED 15,000 per year, while mainland licenses can range from AED 20,000 to AED 50,000 or more, depending on the activity and other requirements. It’s crucial to get a precise quote for your specific business type.

Office Space and Visa Related Costs for Business setup in Dubai

A physical presence is a fundamental requirement for Business setup in Dubai, and this often represents a substantial portion of the overall cost. For mainland companies, leasing a physical office space is mandatory, with rents varying widely based on location, size, and amenities. Prime business districts will naturally command higher prices. Annual office rentals for mainland companies can range from AED 30,000 to over AED 150,000 for larger or premium spaces.

Free zones offer more flexible and often more affordable office solutions. These can include virtual offices (a business address without dedicated physical space), flexi-desks (shared desk access), or dedicated offices. Prices for these options can start from as low as AED 5,000 to AED 20,000 annually, sometimes bundled with the license fee. Your choice will depend on your operational needs and budget.

Another critical cost component is visa processing. If you, as the business owner, or your employees require residency visas, you will incur fees for each application. This typically includes visa application fees, medical fitness tests, and Emirates ID registration. The cost per visa can range from AED 3,000 to AED 7,000, and this is a recurring expense for renewals, usually every two to three years. If you plan to sponsor dependents, additional visa costs will apply for each family member.

Ongoing and Miscellaneous Business setup in Dubai Costs

Beyond the initial setup, there are several ongoing and miscellaneous costs to factor into your budget for Business setup in Dubai.

Annual license renewal is a mandatory ongoing expense. These renewal fees are typically similar to the initial license fees and are crucial for maintaining your legal operating status. Failure to renew on time can result in penalties.

For mainland companies, and some free zones depending on their regulations and your business activity, an annual financial audit might be required. The cost of auditing services can vary based on the size and complexity of your business, ranging from AED 3,500 for small businesses to AED 15,000 or more for larger enterprises. Accounting and bookkeeping services are also vital for compliance, especially with the introduction of corporate tax in the UAE. These services can be outsourced, with monthly fees ranging depending on the volume of transactions and complexity.

Other potential costs include legal and consulting fees if you opt for professional assistance in your setup process, bank account opening fees (some banks may require a minimum balance), and general administrative expenses like utility bills and internet. Businesses with a taxable turnover exceeding AED 375,000 must also register for Value Added Tax (VAT) and ensure ongoing compliance, which might incur additional accounting support.

How Can Meydan Free Zone Help?

When assessing Business setup in Dubai costs, Meydan Free Zone in Dubai consistently emerges as a highly competitive and attractive option. Known for its affordability and efficiency, Meydan Free Zone in Dubai offers a range of packages designed to suit various business needs and budgets.Their license fees are often among the most competitive in Dubai, starting from approximately AED 12,500. This often includes a basic business activity and a flexi-desk option, significantly reducing the initial capital outlay compared to many other jurisdictions. Meydan Free Zone in Dubai also provides streamlined visa processing, with competitive rates for investor and employee visas, simplifying the immigration aspect for entrepreneurs and their staff. With a focus on ease of doing business and cost-effectiveness, Meydan Free Zone in Dubai helps minimize the financial barriers to entry, allowing entrepreneurs to allocate more resources towards growing their core business operations.